Frequently Asked Questions

Why do I need health insurance?

It’s a good idea to have health insurance because it helps protect you and your family financially in the event of an unexpected illness or injury. Medical care can be expensive and if you don’t have health insurance, you may easily find yourself crippled with medical debt. One emergency surgery can cost you thousands of dollars in medical bills. If complications arise during surgery, costs can add up quickly. Signing up for a Network Health Prestige plan can give you peace of mind knowing you're protecting your health and your wallet. Our insurance coverage allows you focus on life and avoid financial stress.

A subsidy is financial assistance provided by the government to help people afford health insurance.

- Premium Tax Credit – This is the amount of money provided by the government that goes toward your health insurance premium. It can help make your monthly payment lower. You can choose to apply the entire amount toward your premium each month (called Advanced Premium Tax Credit, or APTC), or wait until the end of the year and get the money back at tax time. You may qualify for this credit if you purchase a plan on the Marketplace and have an income below a certain level. The government pays a portion of your health insurance directly to your insurance company every month.

When you purchase your health plan, make sure you check to see if you qualify for a subsidy. To get a subsidy, you must enroll in a plan that’s on the Marketplace.

Consider these two questions as you apply for a premium tax credit:

Did you estimate your income correctly?

If you end up making more money than you estimated on your Marketplace application, you could wind up having to pay back some or all the tax credit you received. This payment will be due with your next tax return.

If you end up making less money than you estimated on your Marketplace application, you could qualify for a higher tax credit. This money would be refunded with your next tax return.

To avoid owing money at tax time or to receive a larger refund, you'll want to make sure to report any income changes to the Marketplace during your coverage year.

What happens during tax season?

If you are receiving a Premium Tax Credit, please note the following as you file your taxes:

- You must file a federal income tax return the year after you receive coverage through the Marketplace.

- If you're married at the end of the coverage year, you must file jointly with a spouse.

- You can’t be claimed as a dependent on another person’s tax return for the coverage year.

- You must claim a personal exemption deduction on the coverage year federal income tax return for any dependent listed on your application whose premium is paid with a tax credit.

Learn more about the tax credit from the Internal Revenue Service.

Who is eligible for subsidies?

Eligibility is determined by factors such as your income, family size and where you live. When you get a quote for coverage, we will take you to HealthCare.gov to get your subsidy verified.

The Marketplace (also known as the health insurance exchange) is a website for those who want to shop, compare and enroll in individual and family health plans. Network Health Prestige plans are available on the Marketplace. These plans are separated into three categories for different coverage levels: Bronze, Silver and Gold. Each category is based on the plan’s monthly cost, benefit level and amount you’ll pay over time.

Your agent can help you determine which category is a good fit and help you enroll. If you don’t have an agent, call us at 844-635-1322 and we can help.

Do Affordable Care Act (ACA) health plans require preventive care?

Group, individual and self-insured health plans sold on or after September 23, 2010, must cover specified preventive services when provided by in-network doctors and facilities.

What are preventive care services?

- Alcohol misuse screening and counseling

- Aspirin use to prevent cardiovascular disease for men and women of certain ages

- Blood pressure screening for all adults

- Cholesterol screening for adults of certain ages or at higher risk

- Colorectal cancer screening for adults over 50

- Depression screening for adults

- Diabetes (Type 2) screening for adults with high blood pressure

- Immunization vaccines for adults — doses, recommended ages and recommended populations vary:

- Hepatitis A

- Hepatitis B

- Human Papillomavirus

- Influenza (Flu Shot)

- Measles, Mumps, Rubella

- Meningococcal

- Pneumococcal

- Tetanus, Diphtheria, Pertussis

- Varicella

- Obesity screening and counseling for all adults

- Sexually Transmitted Infection (STI) prevention counseling for adults at higher risk

- Tobacco use screening for all adults and cessation interventions for tobacco users

View a detailed list of ACA preventive care services for adults.

- Breast Cancer mammography screenings every one to two years for women over 40

- Breastfeeding support and counseling and access to breastfeeding supplies, for pregnant and nursing women

- Cervical cancer screening for sexually active women

- Chlamydia screening for women at higher risk

- Contraception: Food and Drug Administration-approved contraceptive methods, sterilization procedures, and patient education and counseling, as prescribed by a health care provider for women with reproductive capacity (not including abortifacient drugs). This does not apply to health plans sponsored by certain exempt “religious employers.”

- Domestic and interpersonal violence screening and counseling for all women

- Gestational diabetes screening for women 24 to 28 weeks pregnant and those at high risk of developing gestational diabetes

- Human Papillomavirus (HPV) DNA Test every 3 years for women with normal cytology results who are 30 or older

- Osteoporosis screening for women over age 60 depending on risk factors

- Sexually Transmitted Infections counseling

- Well-woman visits

View a detailed list of ACA preventive care services for women.

- Autism screening

- Behavioral assessments

- Blood pressure screening

- Developmental screening

- Hearing screening for all newborns

- Height, weight and body mass index measurements

- Immunization vaccines for children from birth to age 18 —doses, recommended ages, and recommended populations vary.

- Obesity screening and counseling

- Oral health risk assessment for young children

- Vision screening for all children

View a detailed list of ACA preventive care services for children.

Specific preventive services are covered without a copayment or coinsurance when services are provided by an in-network doctor or facility. That means you pay $0. This includes flu shots, blood pressure screenings, mammogram screenings and many more services that can help with early detection and prevention of illness. Below is a list of preventive services; you can find a complete list of these services at HealthCare.gov by searching for preventive care.

When can I change my plan?

Open Enrollment Period

For individuals and families, open enrollment begins on November 1, 2021 and ends on January 15, 2022. If you miss open enrollment, you may still be able to enroll under a qualifying life event.

Special Enrollment Period

Special circumstances (called qualifying events) allow you to enroll in a health insurance plan outside of the open enrollment period. A Special Enrollment Period may be available to you if one or more of the following applies.

- You had a baby or adopted a child

- You got married

- You moved to a new state

- You lost coverage under a previous plan

For a complete list of qualifying events, go to HealthCare.gov and search qualifying life event.

Premium – The monthly payment you make for your health plan.

Deductible – The amount you must pay for covered health care services before Network Health begins to pay

Copayment – A set fee you might pay for a type of health care or a prescription drug. For example, your copayment for a doctor visit could be $20. Once your deductible is met, Network Health pays the rest.

Coinsurance – A set percentage you might pay for a type of health care or a prescription drug. For example, 10 percent coinsurance means you pay 10 percent of the cost. Network Health pays the rest.

How Are We Different?

Accountable to Customers, Not Shareholders

Network Health is more than your typical health plan; we pride ourselves on providing exceptional one-on-one service. Our goal is to help you live a healthier life while reducing health care costs. Owned by Froedtert ThedaCare Health, we understand the importance of quality health care, and we believe it should be convenient.

We Speak Your Language

When you call Network Health, you won’t be overwhelmed by health insurance language. We talk like people, not insurance dictionaries.

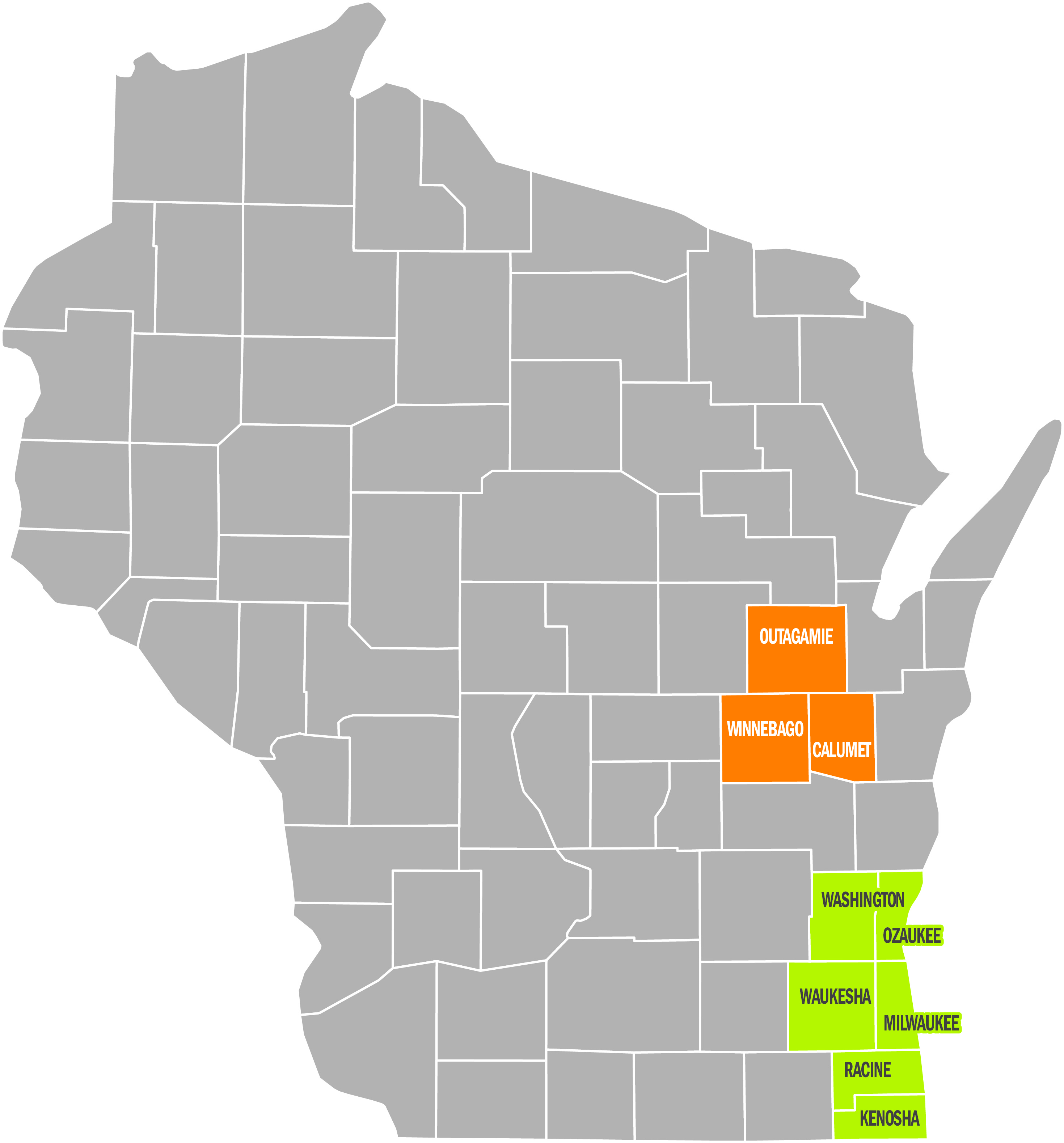

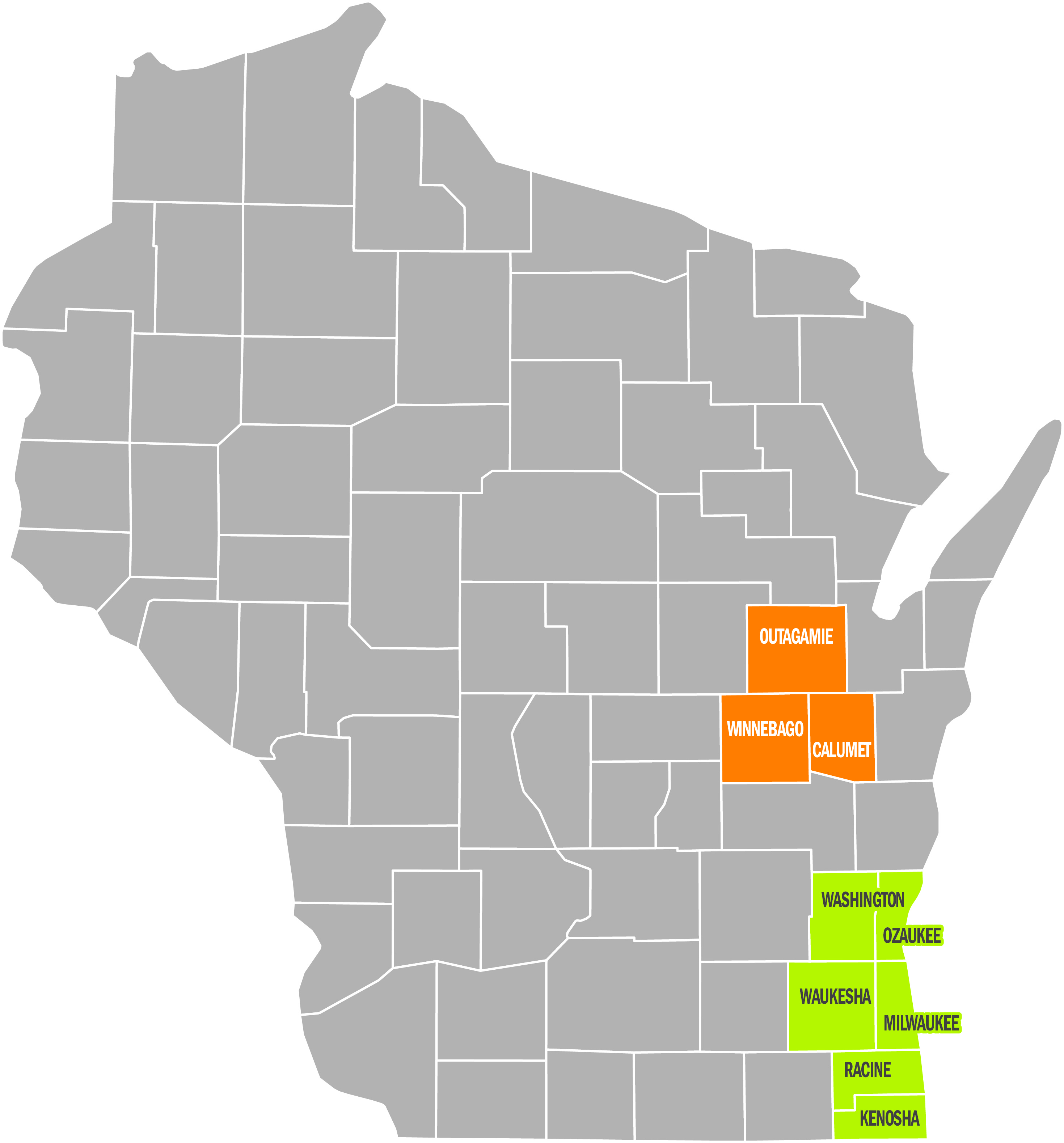

Wisconsin is Home

We're not a nationwide health plan, and we like it that way. We're a locally owned, Wisconsin-based company and we live and work in the communities we serve.

Focused on You

Our plans give you access to health care professionals who can quickly answer your questions and connect you with programs to better your health. If you have a health condition, our nurse care managers can work with you to develop a customized care plan. They can help coordinate care with doctors, explain medical instructions, provide care guidance and more.

Key Information About How to Use Your Plan

Member Portal

For plan information that’s specific to your plan, log in to your member portal account at My Login. See our How to Register cheat sheet for first time login instructions.

We’ve gathered and incorporated customer feedback to deliver a member portal that’s centered around you. The portal is easy to navigate to find information regarding your plan, benefits, claims and more. Plus, it's mobile responsive and viewable from any device at any time. The first time you access the portal, you will need to create an account.

Once you are logged in, you'll find all this and more.

- Benefits and coverage overview

- Out-of-pocket expenses tracker

- Claims detail and status

- Your mobile ID card

- Find a Doctor search and ability to select your personal doctor

- Secure messaging with our local customer service team

Your Personal Doctor (also referred to as a Primary Care Practitioner or PCP)

There are two ways to choose or verify a primary care practitioner or personal doctor.

- Go to My Login to sign in to your account. Once logged in, click your name in the upper right corner to bring up your profile. Select Change My Personal Doctor and follow the steps that appear to choose or change your personal doctor.

- Contact our Network Health customer service department by calling the number on the back of your Network Health ID card.

If you haven’t or don’t wish to choose a personal doctor, the Network Health system will automatically assign a personal doctor based on primary care doctors you have seen recently who are part of your plan and accepting new patients. For those who haven’t seen a personal doctor in two years, Network Health will work with our provider partners to assign you a personal doctor in your area who is accepting new patients. Whether your personal doctor is selected or assigned, you’ll receive the same high-quality care you’ve come to expect.

No Referrals

You are not required to have a referral to see an in-network specialist. Simply make an appointment with the provider. Some specialty offices may require that you first seek care and evaluation at a personal doctor before the office will see you. Emergency care is covered 24 hours a day from any emergency facility.

Services that Require Prior Approval

In some cases, Network Health will need to give approval for you to receive coverage for certain services provided by a specialist or other provider. This is called a prior authorization. Once approved, the service is subject to the terms of your policy and summary of responsibility table.

Your Network Health participating provider or his or her office staff will submit a request on your behalf for authorization. Network Health’s Care Management Department will review the request and make the decision to approve or deny the service. You will receive a letter from Network Health notifying you of the approval or denial of the service or visit. If you need non-emergent, non-urgent care services from an out-of-network provider, you are responsible for confirming that the service has been approved by Network Health’s Care Management Department prior to receiving the service. Please contact the care management department at least 14 days prior to receiving care. For pre-service urgent requests, Network Health will make a decision within 72 hours. For concurrent urgent requests (e.g. for a continued stay at a hospital), Network Health will make a decision within 24 hours.

Your plan provides coverage without authorization, with in-network providers for medically necessary urgent care at a hospital and for emergency health services during an emergency room stay.

If you are admitted to an out-of-network facility after receiving emergency care, or if you receive urgent care from an out-of-network facility, you must notify Network Health within 48 hours or on the next business day of the admission or service. If you are physically or mentally incapable of providing notice within that time, you must provide notice within 48 hours or the next business day of regaining capability. If you are a minor, your parent or guardian must provide notice within 48 hours or the next business day of your admission to an out-of-network facility after receiving emergency care services. If a parent or guardian is not aware of your admission, he or she must notify Network Health within 48 hours or the next business day of becoming aware of the admission. In any case, Network Health must be notified within two business days of discharge from the out-of-network facility or you may be financially responsible for the costs of the services.

If you have questions about which services require authorization, or the status of your authorization request, log in to the member portal at My Login. You can view a list of services that require authorization under My Materials. To see the status of an authorization request, select My Benefits and then My Authorizations.

If you have an authorization request or questions about the prior authorization process, call our care management department at 800-236-0208 or TTY 800-947-3529. For mental health and substance abuse services, please contact Network Health’s Care Management Behavioral Health Department at 800-555-3616. You may leave a message 24 hours a day, seven days a week. Calls about routine (non-urgent) authorization requests received after business hours will be returned the next business day. See the Inpatient Hospital Care section below for more information on urgent hospital stay requests received after business hours.

Requesting Prior Approval for Inpatient Hospital Care

All non-emergency hospitalizations require prior authorization from Network Health. If you are admitted to a non-participating hospital for observation or as an inpatient after a stay in the emergency room, you or your physician must obtain approval from Network Health within 48 hours of the admission or the next business day to receive coverage. If this notification requirement is met, Network Health’s Care Management Department can approve hospital days following that emergency visit up to the time of the notification. Network Health will review any additional days to be sure the stay continues to be medically necessary.

Please call the care management department at 800-236-0208 for all prior authorizations and notifications. For mental health and substance abuse services contact Network Health’s Care Management Behavioral Health Department at 800-555-3616. Bilingual language assistance or translation services are available for members. Network Health also offers services for deaf, hard-of-hearing or speech-impaired members (TTY 800-947-3529).

Requesting an Independent Review

We work hard to ensure member satisfaction, but you have the right to have an independent organization examine certain final decisions made by Network Health. Network Health contracts with three nationally-accredited independent review organizations (IRO) to conduct reviews, and the decisions are binding for both Network Health and the member.

Decisions made by Network Health that are eligible for review are those where we determined the requested care or services did not meet our requirements for medical necessity, appropriateness, health-care setting, level of care, effectiveness, experimental treatment, rescission of a policy or a certificate or coverage denial determination based on pre-existing condition exclusion. Requests for services that are not included in your benefits package are ineligible for independent review (including, but not limited to, benefits limitations and direct exclusions).

Typically, you must complete Network Health’s internal complaint process (called a grievance) prior to starting an independent review. However, you do not need to complete the process if you need immediate medical treatment and a delay could jeopardize your life or health, or if we agree with you that it is in everyone’s best interest to proceed with your concern directly to independent review.

For more information on the independent review organization process, call the number on the back of your Network Health ID card.

Evaluating New Technologies

Network Health evaluates new technologies and new applications of existing technologies on a regular basis. This includes the evaluation of medical procedures, drugs and devices.

New technologies are reviewed by a group of participating physicians and health plan staff who make recommendations for inclusion as a covered benefit. The review process also includes evaluation of information from government regulatory bodies and published scientific evidence.

How Do Health Plans Make Decisions?

Did you know that utilization decisions made about care by Network Health are based on the appropriateness of care and service? Care and service include medical procedures, behavioral health procedures, pharmaceuticals and devices. Decisions are based on written criteria founded on sound clinical evidence and on the benefits outlined in the various Coverage documents. The written criteria are reviewed and approved annually by actively-participating practitioners. Criteria are available to providers, practitioners and/or members/participants upon request. Requests for criteria can be submitted via telephone, fax, electronically, or USPS. Once the request is received, utilization management associates send the requested criteria to the requestor via fax, electronically or USPS.

In addition, treating practitioners may discuss medical necessity denial determinations with the physician review medical director by contacting us at:

Access to our Care Management or Utilization Management teams: call 920-720-1602 or 866-709-0019.

Callers have the option to leave a message 24 hours a day, seven days a week. Messages are retrieved at 8 a.m., Monday through Friday, as well as periodically during the business day. All calls are returned promptly. Calls received after business hours are returned the next business day. Members/Participants, practitioners and/or providers may also send inquiries to the care management department through secure email on the provider portal, fax, and USPS. You can fax the utilization or care management department at 920-720-1916.

Network Health offers TDD/TTY services for deaf, hard of hearing or speech-impaired individuals. Anyone needing these services should call 800-947-3529. Bilingual language assistance or translation services are also available. Callers may leave a message 24 hours a day, seven days a week.

Forms

Authorized Representative Form

This form names a relative, friend, advocate, doctor or someone else to act on your behalf for an appeal or complaint. Send the completed form to Network Health, Attn: Appeals and Grievance Department, 1570 Midway Pl., Menasha, WI 54952.

Dental Reimbursement Form

Members can visit any dentist in Wisconsin and payments are made through a reimbursement process. After receiving services, members fill out a dental reimbursement form and send it to Employee Benefits Corporation, Inc. Network Health will then reimburse them for eligible expenses.

Member Reimbursement Form

If a provider is unable to send a claim this form can be used to submit charges to Network Health.

Protected Health Information Form

When completed and signed by both parties, the Protected or Personal Health Information Consent form allows the specified person (a spouse, relative, friend, advocate, attorney, doctor or someone else) to call and discuss your coverage and plan information if it’s ever needed. Completed forms can be mailed to Network Health, P.O. Box 120, Menasha, WI 54952.

Request for Access Form

This form requests a copy of the protected health information Network Health has about you in a designated record set.

Additional Resources

Surprise Billing Model Notice

All payers must inform their non-Medicare members of their balance billing protections under the No Surprises Act. This notice provides you with what is “balance billing” and “surprise medical claims”, what your rights are under the law, and who to contact if you feel you are being balanced billed.

Preventive Physical vs. Office Visit

Learn the difference between a preventive physical and an office visit.

Find an In-Network Vision Provider

Your vision benefit is available through EyeMed.

How Health Plans Make Their Decisions

Find out how decisions are made about your care. You can also view our medical policies for certain treatments here.

Confidentiality

Network Health ensures that everyone who handles protected health information within the organization maintains confidentiality at all times.

Notice of Privacy Practices

Our policies to ensure that your privacy and information is protected.

Member Rights and Responsibilities

As a member, you have certain rights and responsibilities.